- DP Navigator

- Posts

- What's happening in the rental market?

What's happening in the rental market?

Less rental contracts ytd 2025 than in 2024 - what's the reason and what to do?

Dear subscribers,

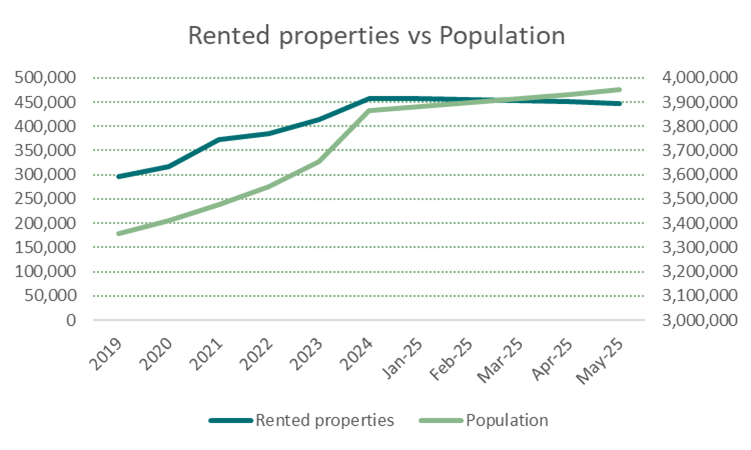

Something strange is happening in the rental market. Dubai’s population continues growing by about 600 net new residents every day. However, rental transactions are declining. Where do those people stay?

We looked at the rental transaction data from Dubai Land department. One would expect the number of new and renewed tenancy agreements to increase about in line with population growth. Of course, some people are buying their place. But unless the ratio of home owners vs renters changes substantially, an increase in population should lead to a similar increase in property renters.

Sources: Dubai Land Department and Dubai Statistics Center

From 2019 to 2024 we see a strong correlation between increase in population and in rented properties. However, in the first 5 months of 2025, population increases and total rental contracts decline.

This is concerning, as rental demand is crucial for property returns. You might say that some buy property for capital appreciation. However, the only benefit of a property is the possibility for someone to live in it. You can either take this benefit yourself or sell it. Selling at a capital gain means selling it to someone who values this benefit higher. Letting the property means selling this benefit year by year. In either case, the market’s willingness to pay rent (now and in the future) for the property is a major component determining its value.

So what’s now the reason for the decline in rental transactions?

We see three possible reasons for the decline:

Some former renters might have bought a property to stay in - we have talked to a few specialist and they confirmed an increase of former tenants buying to live in, especially in the higher end segment.

Due to rising rents, the number of people sharing apartments might have increased - this is possible for people in lower income brackets, especially singles. However it is unlikely for higher income professionals, especially couples and families.

Some might have moved to Sharjah or other Northern Emirates. Again, this is unlikely for people in the higher income brackets, however well possible for Families and singles with lower income.

Some might have moved to Abu Dhabi. Especially Dubai residents working in a company owned by Abu Dhabi Government are pressed hard to move to the Emirate. Some of them are in the higher income brackets.

There can be periods where rental demand lags behind population increase, e.g. when a larger number of people arriving stay in hotels or temporary accommodation. In such cases, we would expect the numbers to adjust later in the year.

The first reason is not problematic. If a tenant becomes an owner, rental demand drops by one, but so does supply. The second and third reason mainly concern lower end units. Reason four is relevant for high end units. However if a Dubai resident takes a job in Abu Dhabi, he/she would also decrease Dubai’s population as his new visa will be from Abu Dhabi. I.e. the 600 population increase per day should already be adjusted for people leaving for jobs in other emirates.

We will certainly continue monitoring the situation and inform you in future newsletters.

Supply continues to increase

What becomes a bit concerning that there is little slowdown in new project launches. Developers continue to launch project after project as increasing per square pricing. Unless population increase accelerates it is possible that over the coming years there will be oversupply, at least in some areas and segments of the market. With more supply coming to the market, it will become more difficult to find tenants paying what investors got promised by the agents they bought from.

Eventually development needs to slow down. This will either come in a controlled way, by Dubai Land Department, or through a market correction where investors stop buying. The second way will take longer, as agents will continue to tell stories of great returns especially to foreign investors. The longer development outpaces population growth, the more severe the downturn.

In the past, the most severe corrections came when oversupply was combined with severe events such as the Global Financial crisis or the combination of VAT and COVID 19. Without such events, corrections are likely more gradual, but also longer.

That there will be a downturn every now and then is not unexpected. This happens in every market. However our long term outlook for Dubai property is still very positive. A lot of the long term fundamentals of the Dubai property market have not changed that substantially. Even at current levels, price per sqft still compares very favorably with similar global cities. Dubai’s growth story is still pretty much intact. Dubai’s population and GDP continues to grow at record rates. So eventually the market will go up again.

Corrections are difficult to time

The problem with corrections is that it is difficult to know when they come and how severe they will be.

I have been waiting for a stock market correction since 2020, when the Dow Jones was in the mid 20s. Now it’s in the 40s and what I thought to be an overpriced level a few years ago, would now be a major correction.

For property prices to correct substantially, you need people to panic and sell their properties at a loss. They are unlikely to do that for as long as they believe the market will eventually recover.

Distressed deals

There can however be distressed deals. If people require money quickly and there are no ready buyers, they will have to sell at substantial discounts. There are still agents advising investors to buy-and-flip, i.e. buying offplan and selling after a short period at a premium. This is a dangerous game, especially if you don’t have the money to make all the payments and then don’t find a buyer.

When people overexposed themselves with offplan properties and are unable to make all the payments, they are risk losing their investment if the developer takes the property back. Especially if they have already paid 30 - 40%, you can negotiate significant discounts to the original price.

So what should we do now?

This depends on your reason for buying, your risk appetite and your market outlook.

If you want to buy to live in - In case there is a correction, you could potentially get a better deal by waiting. However it’s a gamble, as you don’t know when a correction comes and whether there will be desperate sellers for the specific property you like best. Also, the longer you wait, the longer you pay rent and the longer your family is not settled in your final place. Check out our website gives you a comprehensive view of what’s available in each area.

If you want to buy offplan for capital appreciation - Be very selective. The truly good opportunities are becoming rarer. You can also keep cash ready for distressed opportunities. If you can get a good unit at a discount to the original price from a year or two ago, this could give you a great return. However you should aim for units with features that make them unique, such as sea view, beach access, high floor, good facilities, nice garden, proximity to mall or high end business areas (like DIFC). Our website gives you great tools to compare the unit you want to buy and what other projects are around.

If you want to buy and hold for rental return - Here also getting a distressed deal can significantly boost your return. However, it becomes even more important that your unit is unique, so you don’t have to compete on price in an overcrowded market over the coming years. Use our website to get a comprehensive view on the projects to be delivered in the near future and when they will be handed over. Then speak to one of the specialists we work with.

Certainly, don’t buy a unit if you are not sure you will have the money to complete all payments.

Where are the remaining opportunities?

For long term returns, we still believe strongly in Dubai Islands, Maritime City, waterfront communities in Ghantoot (as close as possible to Dubai) and potentially some of the villa developments in Dubai South. Most good projects in those areas are sold out and no new ones are announced. On Dubai Islands a few projects were announced with unclear timeline. However, there are always cancellation units from people who changed their mind, and our independent specialists can help you find one.

If you are interested in any of the above or want to sell a property, please let us help you get in touch with the right real estate professional advising you in your best interest.

As always, with us, you will not get unwanted calls from pushy agents. The agents we work with are independent from us, go through a stringent continuous selection process and will only contact you in the way and at the time you choose.

This month we have a special promotion. If you buy or sell a property through one of our independent specialists, we will send you an iPhone 16.*

Below are the upcoming projects in other parts of Dubai.

Project | Area | Developer | Launch status |

Za'abeel | H&H | 10 June 2025 | |

Expo City | Dubai South Properties | May 2025 | |

Dubai Islands | Ermax Group | Coming Soon | |

Dubai Islands | Ever Glory Developments | Coming Soon | |

Dubai Islands | Prestige One Development | Coming Soon | |

Dubai Islands | Mr. Eight Development | Coming Soon | |

Dubai Islands | Innovate Development | Coming Soon | |

Dubai Islands | Grovy | Coming Soon | |

Dubai Islands | Tomorrow World Group | Coming Soon | |

Dubai Islands | Tomorrow World Group | Coming Soon | |

Dubai Islands | Tomorrow World Group | Coming Soon | |

Dubai Islands | Tomorrow World Group | Coming Soon | |

Dubai Islands | Mr. Eight Development | Coming Soon | |

Ghantoot | IMKAN | February 2025 | |

Dubai South | Dubai South Properties | 9 June 2025 |

If you are interested in any of the above we are also more than happy to put you in touch with the right specialist.

If you like our content, please follow us on social media.

Feel free to share your feedback on this article or on topics you would like us to cover by replying to this email.

If you know someone who would benefit from our content, please share with them.

Until then, keep it up.

Stay tuned,

M&M

*Contact form from this newsletter or dpnavigator.ae website needs to be submitted before June 30, 2025 and property sale/purchase value needs to be above AED 2m. T&C apply

Important Notice:

The information provided in this newsletter (the “Newsletter”) is a consolidation from different publicly available sources combined with the personal view of the author and for informational purposes only. It does not in any way constitute financial, investment, legal, or tax advice. Nothing in the Newsletter or on our website is an offer or advertisement for any specific project or opportunity, but a tool for you to see and compare publicly available information on projects for your own personal purposes. While we give the option to put you in contact with independent agents specializing in different areas, we are neither in control of, nor responsible for any information given by those agents.

While we strive to provide accurate and up-to-date information, the real estate market is subject to fluctuations, and past performance is not indicative of future results.

Investors should conduct their own due diligence and seek professional advice tailored to their individual circumstances before making any investment decisions. We do not guarantee the accuracy or completeness of the information contained herein, and we shall not be held liable for any losses or damages arising from reliance on the Newsletter or our website.

By using the Newsletter or our website, you acknowledge and agree that any investment in real estate carries risks, and you are solely responsible for your investment decisions.

By using the Newsletter or our website, you agree that DP Navigator, its owners, directors and employees are in no way responsible for any direct or indirect losses or damages resulting from your use of the information on the Site.